ASX: CC9 - Chariot Corporation

- Matt Birney

- Jul 29, 2025

- 3 min read

Chariot Corporation: These early lithium numbers would have sent the market nuts 2 years ago

Chariot Corporation Managing Director Shanthar Pathmanathan on 2GB, 3AW, 4BC & 6PR Bulls N' Bears Report

Listen to ASX-listed Chariot Corporation Managing Director Shanthar Pathmanathan talk to Matt Birney on the Bulls N’ Bears Report about Chariot’s new lithium project that has all the early hallmarks of a lithium play that MUST be taken seriously.

TO LISTEN TO THE CHARIOT CORPORATION AUDIO INTERVIEW - CLICK BELOW

ASX-listed Chariot got the market a bit excited over the last couple of weeks with its move into Nigeria’s lithium scene, snapping up a 66.7% stake in a big hard-rock portfolio that at face value looks to have serious legs. The company also has high-grade lithium projects in Wyoming and Nevada in the USA and is busily preparing for what some believe will be a lithium resurgence in 2026.

RADIO INTERVIEW - TRANSCRIPT

Matt Birney - Welcome to Bulls N' Bears brought to you today by mineral explorer Chariot Corporation

Matt Birney - ASX code: CC9

Matt Birney - I'm Matt Birney and I'm joined now by the Managing Director of Chariot, Shanthar Pathmanathan.

Matt Birney - Hi Shanthar.

Shanthar Pathmanathan - Hi Matt.

Matt Birney - Okay, so Chariot got the market a bit excited over the last couple of weeks with its move into Nigeria’s lithium scene, snapping up a 66.7% stake in a big hard-rock portfolio that at face value, looks like it might have serious legs. The company also has high-grade lithium projects in Wyoming and Nevada in the USA and is busily preparing for what some believe will be a lithium resurgence in 2026.

Matt Birney - Okay, Shanthar, this new portfolio, how many projects are in it? How much land do they cover? And where exactly are they? Just orientate me a bit.

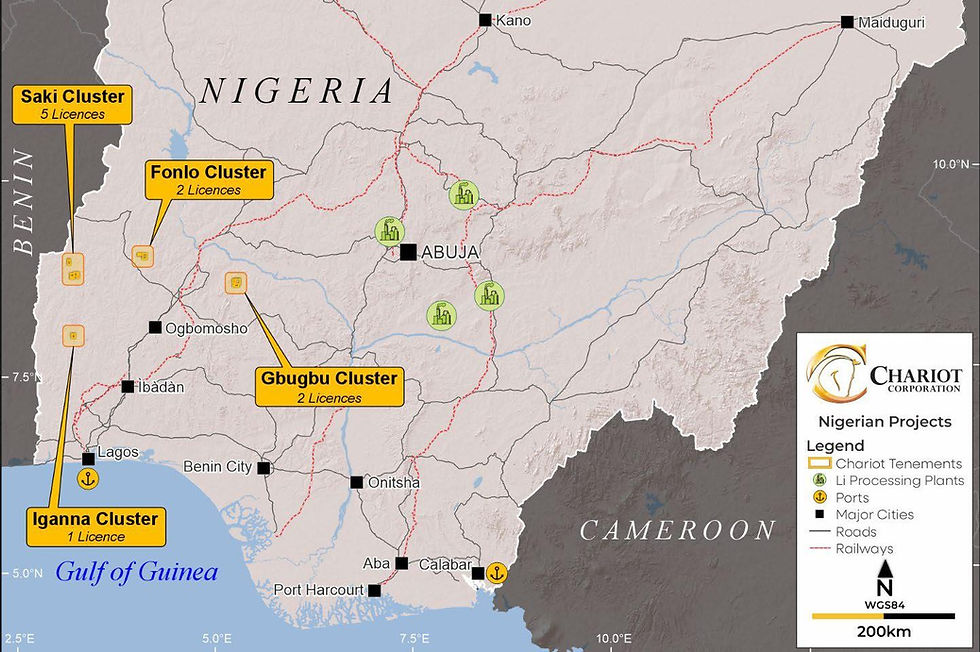

Shanthar Pathmanathan - Matt, there are four projects in this portfolio. It's the largest portfolio in Nigeria. It is it's in the southwest, so very safe part of the country. It's, the projects are individually about 170 to 400 km from the Port of Lagos. So, ideally positioned to supply China out of Nigeria.

Matt Birney - Okay, now, I note you've picked up some really high-grade lithium rock chips across at least three of those four projects, and I want to get them on the record with a bit of a roll call. Firstly, your Fonlo project. How many rock chips did you collect there? What's the highest grade you found and what do they average?

Shanthar Pathmanathan - 11 rock chip samples, average grade of 2.32% and a best grade of 6.46% lithium oxide.

Matt Birney - And what about, I think you pronounced it the Gbugbu project?

Shanthar Pathmanathan - 13 rock chip samples in this case. 2.31% again lithium oxide and 6.59% lithium oxide as best grade.

Matt Birney - And what about the Iganna project?

Shanthar Pathmanathan - 10 rock chip samples, average grade of 2.67% lithium oxide, best grade of 6.48% lithium oxide.

Matt Birney - Serious numbers that would have sent the market wild a couple of years ago. What other indications of lithium have you got?

Shanthar Pathmanathan - The main indication, Matt, is that these properties are all being artisanally mined over the last three years. A couple of those are still in production currently and the material is being mined by the locals and then transported by the owners, Continental Lithium to China and it's being purchased by Chinese refineries and processors and which validates the commercial viability of the product and ready and willing customers.

Matt Birney - Mm I mean is that the plan? If you can get something going here, you want to feed it into the Chinese battery metals juggernaut?

Shanthar Pathmanathan - This is mainly about supplying the Chinese market, Matt. We've got active discussions on that front with Chinese counterparties and the Chinese are most active in Nigeria. Nigeria is probably the fastest growing lithium supply region on the planet, within Africa which itself is growing pretty rapidly as well and the Chinese are the interested party there.

Matt Birney - Mm okay, so you paid about 2.3 million for 66.7%. So well done to you.

Matt Birney - Shanthar Pathmanathan from Chariot Corporation.

Matt Birney - Thanks for joining me on Bulls N' Bears and remember we're only here to give you information, not advice, which you should of course seek independently.

Matt Birney - I'm Matt Birney and this is Bulls N' Bears.

Outro - For more public company interviews go to the money page on the 6PR, 2GB, 3AW and 4BC websites and click the public companies tab.